I am sure you have read the news about how a variety of COVID-19 conspiracy theories have persuaded many people that the pandemic is a fake and manipulative scam, possibly involving a disease no more harmless than flu. Or the ones saying it is a deadly attack weapon designed by some secretive perpetrator. Maybe you have also thought about how this is a modern phenomenon, driven by domestic and foreign manipulators exploiting the easy access to social media. And surely you have felt sorry for the people who believed that Covid was harmless and ended up sick because they failed to protect themselves.

But this story is only

half true. The pandemic is new and the specific conspiracy theories are new,

but conspiracy theories of various kinds are a permanent feature of our society.

People share variations of them in face-to-face conversations, in writing, and

now also on social media. Who are these people spreading conspiracy

theories? Why do they do it? In research published in American Sociological Review, these issues are explored by Hayagreeva Rao, Paul Vicinanza, Echo Zhou,and me.

How do we know that

conspiracy theories help people cope with the pandemic threat? Simple. One of

the drivers of social media Covid conspiracy talk was the infection rate. More

infection, more conspiracy theory talk. Conspiracy theories counter threat and reduce fear.

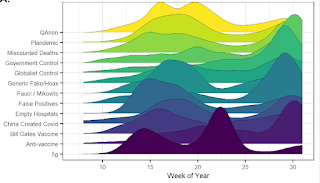

Conspiracy theories have

moderate and extreme versions. This is easy to tell by looking at their

content. The “film your hospital” conspiracy theory was about hospitals

pretending to be filled with patients (for money, or for political reasons).

This is moderate. An example extreme version is Bill Gates orchestrating the

pandemic for various evil purposes. Another is Covid

being a way of controlling people while constructing malicious 5G towers.

Why does it matter that

the conspiracy theories differ in how extreme they are? Simple, again. One of

the drivers of social media Covid conspiracy talk is that the moderate versions

are gateways that get people into conspiracy talk. Later many of them graduate

to extreme versions.

Conspiracy theorists can

spread different conspiracy theories, often at the same time. And remarkably,

often conspiracy theories that contradict each other. Logically, Covid can’t

both be a harmless scam and a deadly weapon, but the same people would spread

both within the span of a week (and yes, these were people, not bots – we can

identify bots).

How to make sense of

this? Maybe the best way to sum it up is that conspiracy theories are a form of

reality denial. When the reality is threatening and difficult to explain and

rationalize, as it is during a pandemic, a conspiracy theory offers an escape.

But the escape is not perfect, because our society is full of people who don’t

believe in conspiracy theories and will challenge the believers. That’s why some poeple have multiple conspiracy theories. Whenever one of them is

challenged, the conspiracy theorist can fall back on another.

What to do about such

reality denial? The starting point must be that it is not simple ignorance.

Reality denial is motivated reasoning, and facts alone will not help. Explain how one conspiracy theorist is false, and the conspiracy theorist will fall back on another. Because

it is motivated by a wish to reduce and control threat, the solution always

involves explanation of how the threat can be reduced through human action. It

is a difficult conversation because masks, isolation, and vaccinations all have

this effect, but conspiracy talk does not go away unless we explain how the threat can be reduced through joint action such as vaccinations and personal caution.